What Backs Bitcoin?

When someone asks, “What backs Bitcoin?” they’re really asking: what gives it value? It’s a fair question, but it reveals a common misunderstanding about what makes any money “good.” Gold, for example, wasn’t valuable because something external propped it up—it was valuable because of its own properties: scarcity, durability, and divisibility. These traits made gold the world’s dominant store of value for millennia. Gold didn’t need backing; it was the backing.

Today, Bitcoin fills a similar role for the digital age. Nothing external backs Bitcoin. Instead, its value comes from its well-designed monetary characteristics—secured and enforced by cryptography and a decentralized global network. As a bearer asset, Bitcoin isn’t a promise or an IOU; it’s digital gold, engineered from day one to be the best money possible.

Money: A Story of Upgrades

Throughout history, societies have upgraded their money. The earliest forms of money—livestock & grain – were replaced with superior shells & beads, which gave way to gold because gold was more scarce and durable. Each upgrade wasn’t about what “backed” the new money, but about which properties made it superior to what came before.

Paper money replaced gold coins because it was easier to use and (originally) could be exchanged for gold. But when the U.S. broke the gold link in 1971, money became just paper with presidents’ faces printed on it. U.S. dollars were no longer backed by gold, which was certainly not an upgrade over the previous gold standard. Instead of using downgraded fiat money as a store of value, people turned to other stores of value: equities, real estate, even rare art. But do these assets function better as money than Bitcoin?

Bitcoin vs. Other Stores of Value

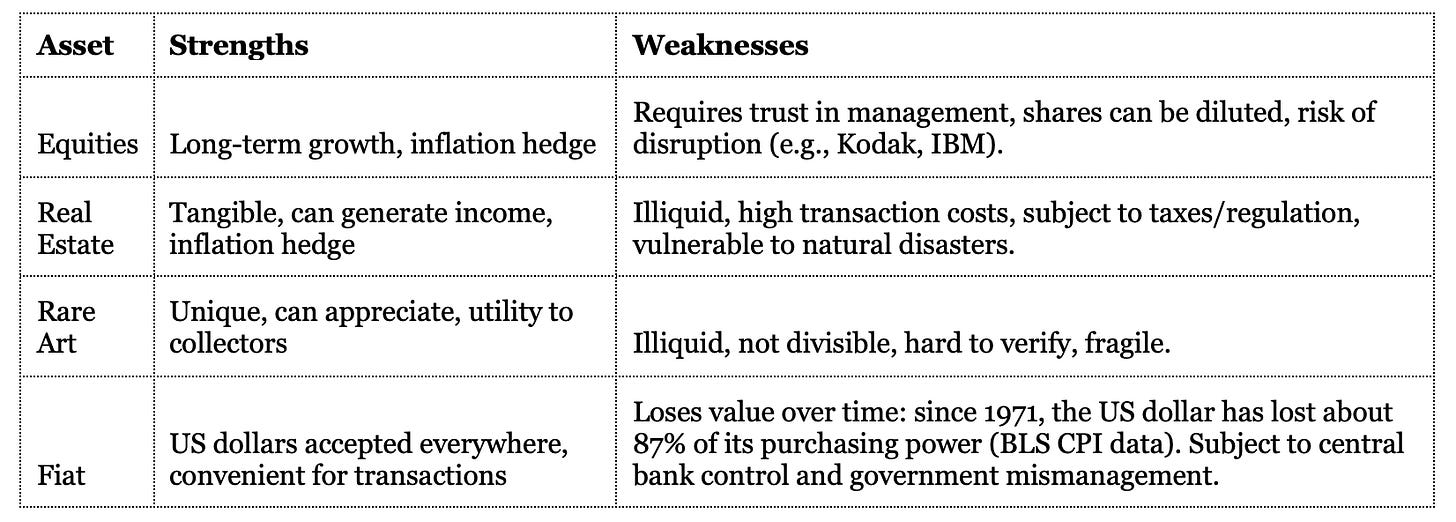

Let’s compare Bitcoin with other popular stores of value, highlighting both strengths and weaknesses:

Each of these assets has benefits, but also critical weaknesses as money. None were designed to be used globally, instantly, and securely across borders.

Bitcoin’s Unique Advantage

Bitcoin is different. It was engineered to be money from day one, scoring top marks on the traits that matter: scarcity (fixed supply), durability (digital, not physical), divisibility (can be split into tiny units), and portability (can be sent anywhere in minutes). Its decentralized network is secured by computers all over the world, making it nearly impossible to shut down or hack.

Bitcoin is volatile, yes, but that’s to be expected of any nascent money. Over time, as adoption increases and the network matures, volatility tends to decrease—just as it did with other revolutionary technologies, and even gold itself.

Bitcoin Doesn’t Need to “Replace” Anything

Bitcoin doesn’t need to replace real estate, stocks, or art to succeed. Each asset class has its place. But with only 0.2% of global assets currently invested in Bitcoin, it doesn’t take much capital flowing in for Bitcoin’s relevance to grow. Its perfect score on the traits of money makes it an attractive option for those seeking a long-term store of value—especially as fiat currencies continue to lose purchasing power.

And the longer Bitcoin survives, the stronger it gets—a phenomenon known as the Lindy effect: the longer something non-perishable (like a technology or idea) has survived, the longer it’s likely to last. Every day Bitcoin endures, its odds of lasting far into the future increase.

Bitcoin isn’t here to dethrone stocks, real estate, or art—it’s here to offer something radically different: a form of money engineered for the digital age - the next upgrade in money’s history. Its perfect score on reliable monetary traits is leading to increased global adoption. And every year it survives, the odds of its long-term success grow. History shows that superior money always wins. The real question isn’t what backs Bitcoin, but what Bitcoin will back in the future.

This publication is for informational and educational purposes only — not investment, legal, tax, or accounting advice. Nothing herein constitutes a solicitation, recommendation, or offer to buy or sell any security or strategy. The author may hold — and may buy or sell without notice — securities, derivatives, or other instruments referenced. All opinions are the author’s, expressed in good faith as of publication, and subject to change without notice. Information is believed accurate but provided “as is,” without representations or warranties; errors or omissions may occur. Any forward-looking statements involve risks and uncertainties that may cause actual results to differ materially. Past performance is not indicative of future results. Do your own research and consult a qualified, licensed adviser who understands your circumstances before acting on this content. To the fullest extent permitted by law, the author and publication disclaim liability for any loss arising from reliance on this material.