The Great Economic Inversion

When Abundance Meets Scarcity

The economic paradigm that has defined human civilization for centuries is about to flip on its head. As artificial intelligence and robotics drive production costs toward zero, we're witnessing a fundamental shift where scarcity moves from the production side to the monetary side of the economy. In this new reality, Bitcoin's fixed supply positions it uniquely to capture significant value from technological innovation, serving as the primary monetary infrastructure for an economy where abundance in goods meets scarcity in money.

The Collision of Deflationary Forces

We stand at the intersection of two powerful deflationary forces that have never coexisted in human history. On one side, AI and robotics are driving production costs closer to zero, the same way technology has always driven efficiency and lower costs, but at a faster pace. This is likely to create abundance in goods, services, and information. On the other side, Bitcoin is deflationary money with a fixed supply cap, fundamentally different from the inflationary fiat currencies that have dominated the modern era.

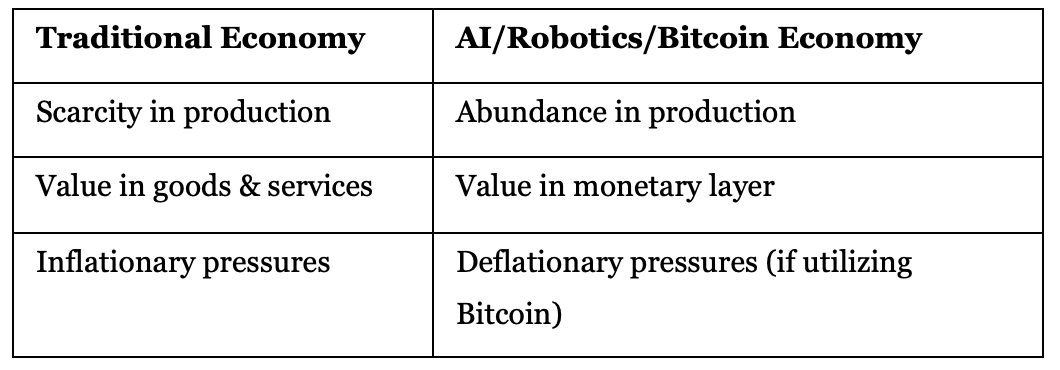

When these forces collide, they create an economic inversion:

This inversion represents more than just a technological shift—it's a complete restructuring of how value is stored and transferred in the global economy.

Value concentrates in Bitcoin

As AI enhances productivity and creates new markets, it generates significant monetary value that must flow somewhere. Bitcoin, well-documented as the ultimate absorber of liquidity, is likely to see inflows from this AI-created monetary value. The increased productivity from AI essentially creates more wealth, some of which will seek the hardest, most reliable store of value available.

When production becomes abundant and money is scarce, more goods are chasing less money. This is antithetical to the previous economy, where scarce goods chased increasing amounts of money. This fundamental shift means value now flows towards the monetary layer rather than the production layer of the economy.

Deflationary environments also naturally lower individuals’ time preference because hard money gains purchasing power over time, making saving more attractive than spending. Waiting to purchase goods becomes economically rational because prices will likely be lower tomorrow when denominated in scarce money such as Bitcoin.

Direct Technological Integration

Bitcoin isn't just passively benefiting from AI advancement—it's also actively integrating with emerging technologies to become essential infrastructure. Bitcoin’s Lightning network enables instant micropayments, ideal for AI-to-AI transactions and automated systems. Notably, the first AI-to-AI bitcoin transaction occurred in 2024, demonstrating the practical reality of this integration.

AI agents will likely use Lightning, a layer 2 solution, to transact between one another, given that AI agents cannot transact using traditional banking. This creates a natural symbiosis where AI systems require Bitcoin's monetary infrastructure to function in an autonomous economy.

Layer 2 solutions – secondary protocols built on top of the Bitcoin blockchain – further support complex smart contracts and programmable money applications, positioning Bitcoin as the foundational monetary layer for sophisticated AI-driven economic systems.

Corporate Treasury Revolution

Forward-thinking companies are already recognizing this paradigm shift towards Bitcoin-based systems. A growing number of corporations are using Bitcoin for treasury management, with profits from operations increasingly allocated toward Bitcoin instead of dividends or stock buybacks. This strategy actually retains capital rather than surrendering it, making corporations antifragile.

Companies like Block exemplify this trend. First, Block holds 8,584 Bitcoin on their balance sheet and invests a portion of gross profits into buying more Bitcoin. Second, Block uses their payment technology profits to support ongoing Bitcoin development, integrating Bitcoin transactions into their Square point-of-sale hardware. This creates a virtuous cycle where technological innovation directly supports Bitcoin infrastructure development.

21st Century Money for a 21st Century Economy

Rather than competing with emerging technologies like artificial intelligence and robotics, Bitcoin serves as complementary infrastructure that captures value from tech advancement across industries. As AI and robotics transform 21st century economies, holding 21st century money becomes not just advantageous but necessary. The collision of abundant technology with scarce money creates a 180-degree flip from previous paradigms, establishing long-term structural advantages for Bitcoin as innovations continue to reshape economic systems.

The New Economic Reality

We're witnessing the emergence of an economy where scarcity has fundamentally shifted from the production side to the monetary side. In this new paradigm, Bitcoin is not just digital gold—it is the foundational monetary infrastructure for an AI-driven world where abundance in goods meets scarcity in money.

From AI-to-AI transactions on Lightning to corporate treasury adoption, the practical integration of Bitcoin with emerging technologies is creating the monetary foundation for tomorrow's economy. Because Bitcoin is the best money the world has ever seen, liquidity and value ultimately find their way into Bitcoin, one way or another.

For investors, technologists, and policymakers, understanding this paradigm shift is essential for navigating the economic transformation underway. The question isn't whether this shift will happen, but how quickly and completely it will reshape the global economic landscape.

This publication is for informational and educational purposes only — not investment, legal, tax, or accounting advice. Nothing herein constitutes a solicitation, recommendation, or offer to buy or sell any security or strategy. The author may hold — and may buy or sell without notice — securities, derivatives, or other instruments referenced. All opinions are the author’s, expressed in good faith as of publication, and subject to change without notice. Information is believed accurate but provided “as is,” without representations or warranties; errors or omissions may occur. Any forward-looking statements involve risks and uncertainties that may cause actual results to differ materially. Past performance is not indicative of future results. Do your own research and consult a qualified, licensed adviser who understands your circumstances before acting on this content. To the fullest extent permitted by law, the author and publication disclaim liability for any loss arising from reliance on this material.

Continue to keep eye on how Agent to Agent transaction volume pick up using bitcoin.