Physics over Finance

AI Needs Energy. Energy Needs Infrastructure. Infrastructure Needs Materials. Materials Need Energy.

The AI revolution has hit a wall of thermodynamics. Energy can’t be manufactured by policy, and it can’t be scaled as fast as code. That constraint changes everything about which assets outperform over the next decade.

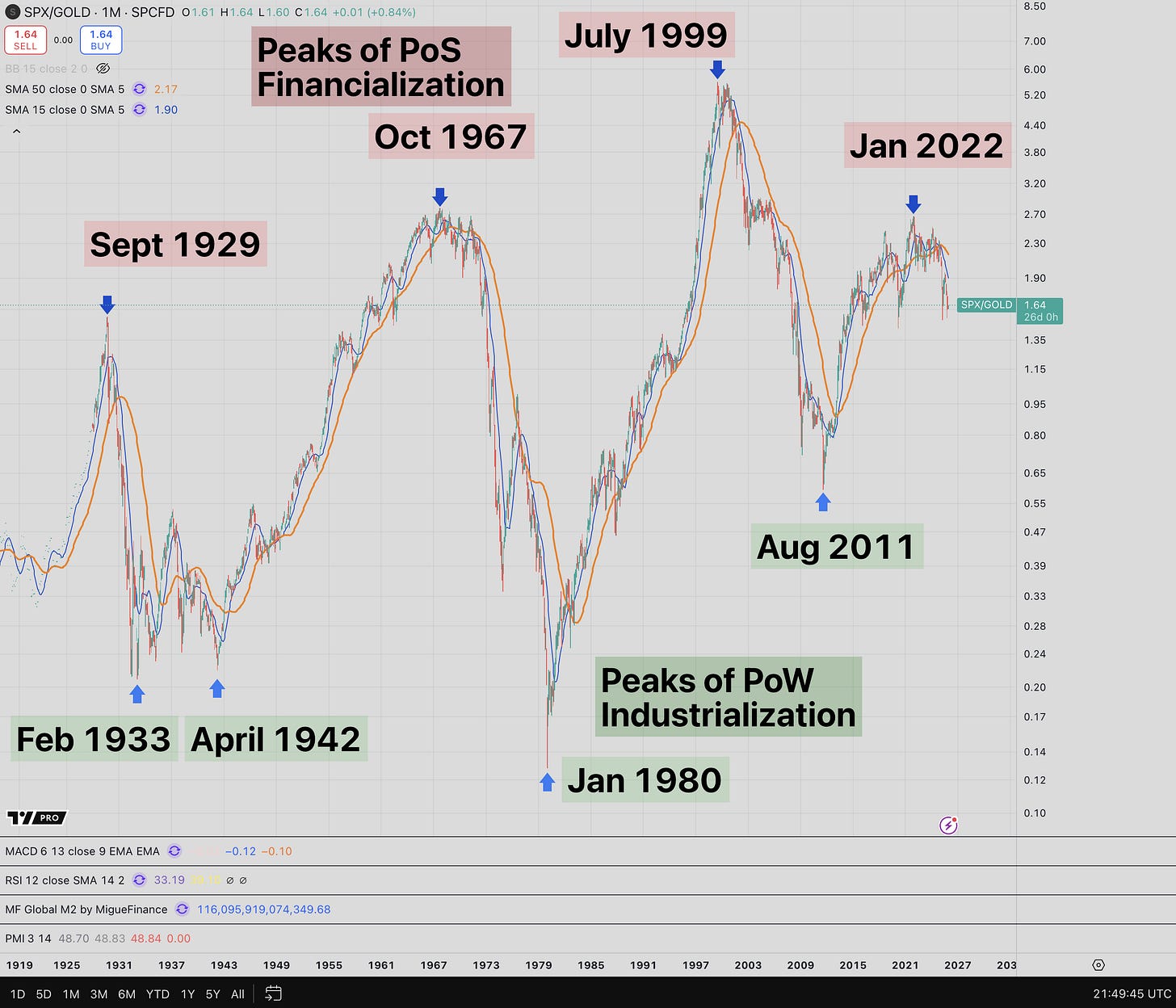

This pattern has repeated four times over the past century. 1929, 1967, 1999, 2022. Each red box in the chart below marks a peak in financialization, when investors believed paper claims would compound forever. Each green box shows what happened next: 12-13 year periods where the S&P 500 fell 75%+ in gold terms.

We’re in year four of the latest cycle. The catalyst this time: AI-driven reindustrialization has collided with thermodynamics. And with time, thermodynamics always wins.

The S&P 500 measured in gold ounces instead of dollars. After financialization peaked in January 2022, we are now trending toward industrialization. Chart credit to Dr. Jeff Ross.

When Building Becomes Paramount

In 1942, Ford wasn’t making cars—it was making B-24 bombers. Stock buybacks didn’t matter; factory production did. What determined who won World War II wasn’t corporate profits or financial engineering. It was steel production, aluminum capacity, rubber, and oil refining. Real industrial capacity was the only scorecard that mattered.

The Manhattan Project made this explicit: the US spent $2 billion on enrichment facilities that consumed staggering amounts of electricity. Creating the atomic bomb required massive energy inputs. You couldn’t finance your way to fission. And it was this energy-based weapon, the product of industrial capacity and thermodynamics, that ended the war with Japan. Real energy produced real output, and real output determined the outcome of the war.

Financial assets didn’t win that war—industrial capacity did—and that was reflected in the S&P 500’s steep decline in gold terms. Those holding gold preserved purchasing power while those holding financial assets watched them decline. When nations must build at scale, hard assets outperform for a decade or longer.

The same pattern is emerging today, but the catalyst has changed. Forty years of offshoring manufacturing to maximize corporate profits is ending. China no longer accepts dollars as payment for real goods. Instead, they convert proceeds to gold. While Wall Street chases software unicorns, Beijing is stockpiling gold and commodities. The AI buildout requires trillions in datacenter infrastructure, a massive grid buildout, and reshoring of manufacturing to reduce supply chain vulnerabilities. These are necessities that require real resources. As Craig Tindale writes, “AI is not just code; it is physical infrastructure of copper busbars, massive water cooling systems, and vast energy grids dependent on transformers and transmission lines.” (X article)

The Bottleneck

Those focused on semiconductors and the newest AI models aren’t necessarily misled, but they’re looking at half the trade. The AI revolution has expanded from compute alone to include to energy and power.

Microsoft’s CEO recently confirmed the problem: compute isn’t the bottleneck—energy is. The company has racks of H100 GPUs collecting dust because they cannot plug them into power. Three to seven-year wait times for datacenter power connections are now standard across the industry.

Energy is economic oxygen. You can fake financial statements, but you can’t fake kilowatt-hours. And right now, energy demand is surging from AI while energy supply remains constrained by decades of underinvestment.

The grid can’t be built without physical materials. Copper for transmission lines, rare earth elements for transformers and motors, lithium for energy storage, silver for solar panels, steel for towers and structures.

And here’s the kicker: every single one of these materials requires massive energy inputs to locate, extract, process, transport, and fabricate. Critical materials are stored energy in physical form.

The sovereign bid for critical materials proves governments understand this. The US critical minerals list exploded from 35 items in 2018 to 60 items in 2025. Western governments are selling bonds to buy commodities, converting paper claims into physical resources. This is an implicit admission that financial assets will lose purchasing power while hard assets with real demand will preserve it.

The Mechanism

When governments must redirect capital from financial assets toward physical buildout, they implement financial repression—deliberately suppressing real bond returns by keeping interest rates below inflation. This steers capital towards building assets and infrastructure that are tied to real productivity and energy.

Asset Classes That Win

Electrical infrastructure. Grid equipment manufacturers and electrical contractors own the physical assets that generate, transmit, and distribute power. These companies own the critical infrastructure for the entire reindustrialization buildout.

Gold has been money for 5,000 years for one main reason: mining gold requires proof-of-work. In other words, energy expenditure that cannot be faked. Central banks are converting financial assets to gold at an accelerating pace.

Bitcoin is proof-of-work mining—electricity and energy—converted directly into a monetary asset. Bitcoin has a fixed supply, enforced by code and secured by thermodynamics. And Bitcoin protects from the same currency debasement that’s crushing long-term bonds.

Each of these assets either is the energy bottleneck (infrastructure) or requires proof-of-work energy expenditure that can’t be faked (gold, Bitcoin). When governments must build and currencies must debase to fund it, these assets preserve purchasing power.

Physics over Finance

AI needs energy. Energy needs infrastructure. Infrastructure needs materials. Materials need energy. This is a reinforcing loop that is unlikely to break for another 7+ years.

The chart shows this pattern held for a century. Four financialization peaks. Four hard asset dominance periods. Each lasting 12-13 years with 75%+ declines in SPX/GOLD. It’s holding now.

When assets tied to energy preserve purchasing power and paper claims get destroyed, own what can’t be printed.

This publication is for informational and educational purposes only — not investment, legal, tax, or accounting advice. Nothing herein constitutes a solicitation, recommendation, or offer to buy or sell any security or strategy. The author may hold — and may buy or sell without notice — securities, derivatives, or other instruments referenced. All opinions are the author’s, expressed in good faith as of publication, and subject to change without notice. Information is believed accurate but provided “as is,” without representations or warranties; errors or omissions may occur. Any forward-looking statements involve risks and uncertainties that may cause actual results to differ materially. Past performance is not indicative of future results. Do your own research and consult a qualified, licensed adviser who understands your circumstances before acting on this content. To the fullest extent permitted by law, the author and publication disclaim liability for any loss arising from reliance on this material.

Exceptional framing of the energy bottleneck problem. The Microsoft example about idle H100s waiting for power hookups is wild, but it perfectly captures how physical constraints trump software scalability. The reinforcing loop you laid out (AI needs energy, energy needs materials, materials need energy) is somethign I keep running into when mapping out infrastructure projects. The 3-7 year datacenter power wait times arent getting better anytime soon either.