From Zero to Global

Bitcoin's Volatility is an Invitation

Bitcoin’s price volatility has long been criticized as evidence of unsuitability as money or a store of value. However, this perspective fundamentally misunderstands the nature of emerging monetary systems and the economic dynamics underlying Bitcoin’s price discovery. Bitcoin’s volatility actually indicates its growing success and adoption. Furthermore, volatility is not equal to risk: volatile things are not necessarily risky, and non-volatile things are not necessarily safe. Volatility is not only inevitable but necessary for any growing asset transitioning from non-existence to global money.

Below are four reasons that Bitcoin is not too volatile.

Fixed Supply

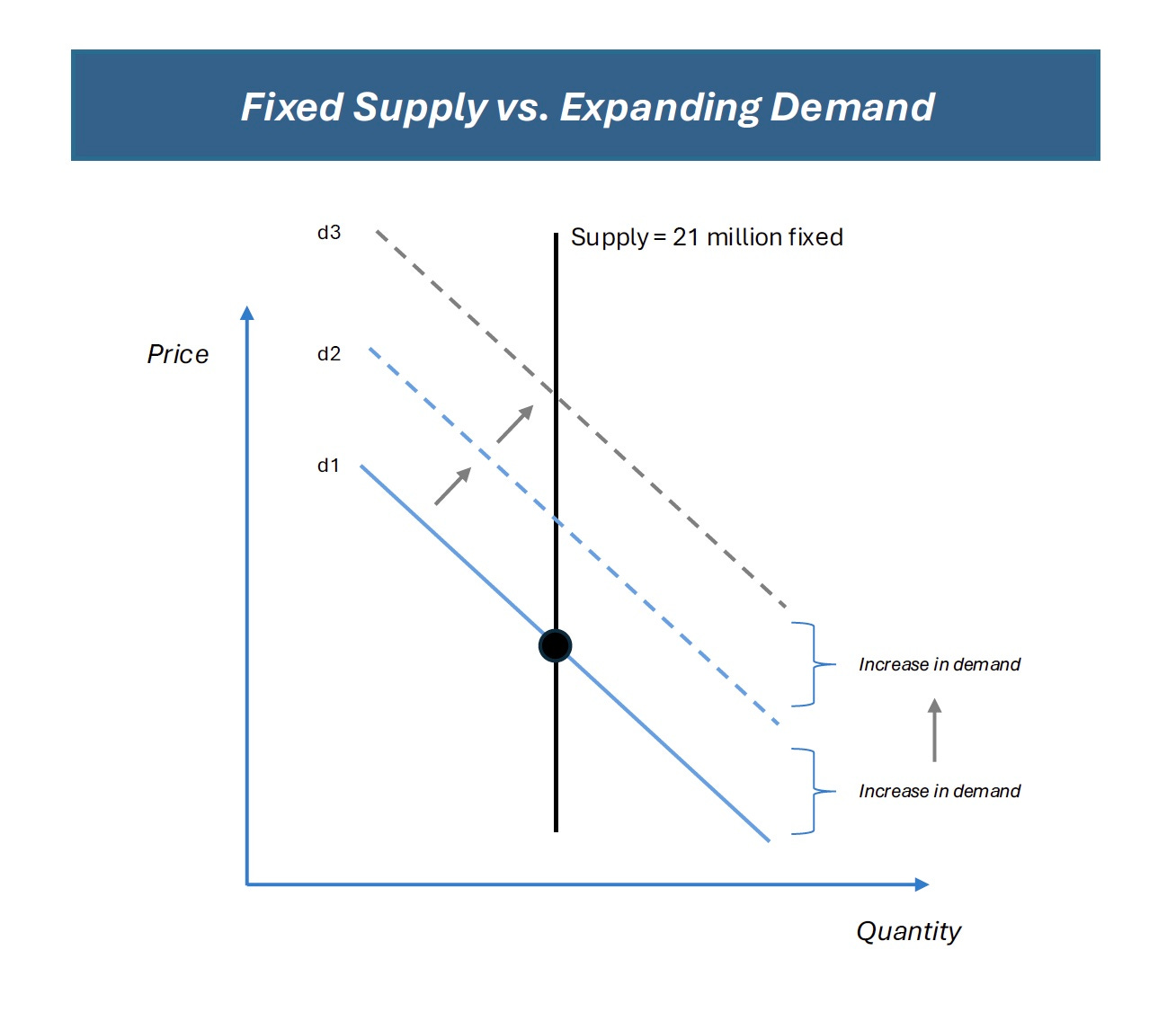

Bitcoin’s volatility stems in part from its monetary design: a fixed supply cap of 21 million coins combined with a transparent, pre-determined issuance schedule. This design creates unique supply-demand dynamics which generate price volatility. In traditional commodities, increased demand typically stimulates increased supply. As more people demand corn, houses, or even gold, producers of these commodities increase production to meet the demand. If suddenly there is a drop in demand for commodities, producers make less. These supply responses from producers keep prices in check, both on the downside and upside.

With Bitcoin, supply is entirely inelastic – it does not respond to increased or decreased demand. Since supply doesn’t change as a result of changing demand, what is left to change? Only the price. Thus, as demand for Bitcoin increases – whether from institutional adoption, regulatory tailwinds, or macroeconomic uncertainty – the price must adjust upward since supply cannot respond. If demand and price rise too fast – perhaps as everyone jumps on the Bitcoin bandwagon – eventually the price reaches a short-term peak where demand is exhausted. At this point, prices can fall sharply because supply cannot contract to support price levels. This dynamic creates more pronounced price movements than would occur in markets where supply can adjust to meet changes in demand.

Volatility ≠ Risk

The financial industry often conflates volatility with risk, creating misconceptions about the true nature of investment safety. Volatile things are not necessarily risky, and seemingly stable systems may actually harbor dangerous fragilities that manifest over time.

Bitcoin’s price volatility occurs within a system designed for antifragility through decentralized consensus and transparent rules. While prices fluctuate dramatically, the underlying network has operated for 16 years without interruption, processing transactions and maintaining security regardless of market conditions. The roots of the Bitcoin tree are stable, while the branches sway in the wind of people’s emotions and the current news cycle. What matters is not that the branches sway, but that the roots are stable.

Bitcoin’s strong roots lay in stark contrast to traditional financial systems that appear stable yet contain hidden fragilities that periodically fracture into systemic crises. Central bank monetary policy exemplifies this stability-fragility trade-off. By suppressing short-term volatility through interest rate manipulation and money printing, central banks create an illusion of stability while building systemic fragilities that eventually manifest as financial crises. A clear example is the 2008 financial crisis. After both 9/11 and the Dot-Com crash of 2001-2002 caused severe panic, the Federal Reserve kept interest rates low and used expansionary policies to suppress market volatility, creating an illusion of stability. Low interest rates encouraged excessive risk-taking and leverage across the financial system – particularly housing. When the bubble burst in 2008, these hidden fragilities were exposed, leading to a severe global crisis. The very policies that reduced short-term volatility ended up amplifying long-term risk. Artificial stability breeds fragility.

The antipole to central banks’ unpredictable monetary policies, Bitcoin’s decentralized, fixed monetary policy eliminates the risk of having fallible humans, like those who comprise central banks, make short-sighted decisions. Bitcoin provides diversification away from fiat systems’ perennial fragility, even if this protection comes with the cost of price volatility.

Time Horizons Matter

Those who criticize Bitcoin’s volatility are often focused on short-term movements rather than long-term performance trends. But since Bitcoin’s current use case is as a long-term store of value, not as an emergency fund that may be needed tomorrow, those criticisms are misplaced. For investors with time horizons of five years or more, Bitcoin’s track record demonstrates exceptional consistency in generating returns higher than other asset classes. The track record suggests that investors focused on preserving and growing wealth should view Bitcoin’s volatility as noise – a change in the wind – rather than a fundamental impediment to Bitcoin’s roots.

From Zero to One

Peter Thiel’s concept of moving from zero to one – creating something from nothing – helps one to understand Bitcoin’s current phase of development. Any sufficiently revolutionary technology must necessarily experience high volatility as it transitions from non-existence to widespread adoption, particularly when the user base and market cap remain small relative to the potential addressable market. Early markets are characterized by imperfect knowledge distribution, limited liquidity, and rapid shifts in sentiment as participants grapple with valuing fundamentally new concepts.

Bitcoin’s volatility today mimics that of early-stage Apple and Amazon. In 2000, Apple fell 52% in a single day after issuing a warning around earnings. Also in 2000, Amazon fell 90% in the Dot-Com crash. Both recovered within 3-4 years and are among today’s most powerful companies. Gold also experienced outsized volatility as it became money, both as a result of coin clipping and sudden supply gluts. Downside volatility does not spell doom.

Just as the volatility of Apple, Amazon, and Gold decreased as they gained market share, Bitcoin’s volatility will likely decrease as it gains market share as well.

An Invitation

For those with vision and patience, volatility is not a warning sign but an invitation: to participate in the birth of a new monetary order, to weather the storms of price discovery, and to reap the rewards as the roots of Bitcoin’s system deepen and strengthen. As adoption grows and the world adjusts to a fixed-supply money, today’s volatility will become tomorrow’s footnote – a testament to the growing pains of something truly revolutionary. The winds may howl, but the roots remain unshaken.

This publication is for informational and educational purposes only — not investment, legal, tax, or accounting advice. Nothing herein constitutes a solicitation, recommendation, or offer to buy or sell any security or strategy. The author may hold — and may buy or sell without notice — securities, derivatives, or other instruments referenced. All opinions are the author’s, expressed in good faith as of publication, and subject to change without notice. Information is believed accurate but provided “as is,” without representations or warranties; errors or omissions may occur. Any forward-looking statements involve risks and uncertainties that may cause actual results to differ materially. Past performance is not indicative of future results. Do your own research and consult a qualified, licensed adviser who understands your circumstances before acting on this content. To the fullest extent permitted by law, the author and publication disclaim liability for any loss arising from reliance on this material.