Fiscal Dominance

The Inflation Engine

The Fed is no longer in control. For decades, investors have looked to central banks – especially the Federal Reserve – as the ultimate authority on inflation. They raise rates to cool inflation, cut rates to stimulate the economy. It was predictable and mechanical. But now, something has changed. The levers of monetary policy have lost their power, and fiscal policy – how much the government spends and borrows – is taking the wheel. This shift, known as fiscal dominance, is reshaping inflation, how markets respond, and how wealth is preserved and grown. Understanding this paradigm shift is essential for navigating what comes next.

What is Fiscal Dominance?

Fiscal dominance occurs when government debt and deficits grow so large that central banks can no longer control inflation through interest rate policy. Instead, fiscal policy – government spending and borrowing – takes over as the main driver of economic outcomes.

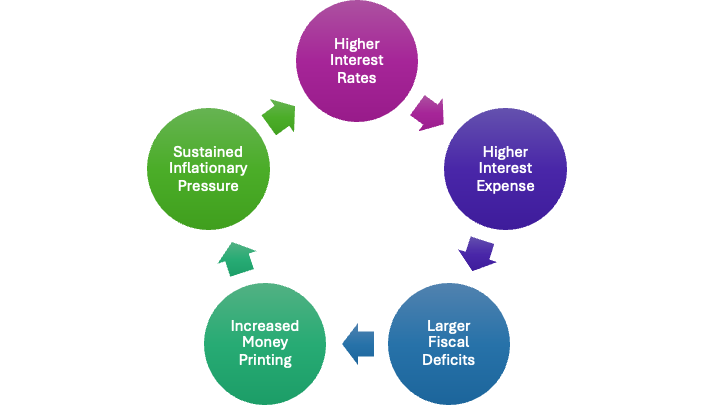

In this regime, raising interest rates doesn’t slow inflation as the traditional system would lead us to expect. In fact, raising rates can worsen inflation. Higher rates mean higher interest payments on the national debt, which increases fiscal deficits and forces even more government borrowing. If central banks step in to absorb that debt – as they have recently – they inject more money into the system, fueling inflation. The result is a self-reinforcing loop: deficits drive money creation, which fuels inflation. If the Fed then raises rates with the goal of lowering inflation, as they have since 2022, it leads to higher interest expenses and even larger fiscal deficits, which drives even more money creation and inflation. The end result – higher inflation – is the exact opposite of the Fed’s goal, and is counterintuitively a result of higher interest rates.

Why the U.S. is in Fiscal Dominance

Debt Levels: Federal debt is approaching 130% of GDP, well past the point where monetary tools are typically effective.

Persistent deficits: These are not cyclical. They’re structural, rooted in entitlements, healthcare costs, and compounding interest. Without major reform, deficits will persist.

Rising interest costs: Interest on the debt is now one of the largest items in the federal budget – larger than defense spending.

Shrinking Foreign Demand: Foreign ownership of U.S. Debt has declined from 47% to 30% over the past 15 years. Increasingly, the Fed is becoming the buyer of last resort, which necessitates printing money to buy the debt.

The Inflation Mechanism

Debt-fueled money supply growth: as fiscal deficits widen, central banks step in to buy the debt, which is necessary to fund government spending. To buy this debt, central banks print money, which expands the money supply and pushes inflation higher.

Rate Hikes Backfire: Higher interest rates increase the government’s interest expense bill, which worsens deficits, necessitating more borrowing.

CPI and Asset Inflation: Along with pushing up consumer prices, this new liquidity often flows into assets such as equities, real estate, gold, and Bitcoin.

Currency erosion: Chronic deficits and debt monetization undermine faith in the currency over time, leading to currency depreciation.

The Interest Rate Trap

If the Fed recognizes that high interest rates are problematic and decides to lower them, it doesn’t necessarily resolve the underlying issue. In an environment of low rates combined with persistent high inflation, borrowing becomes more attractive—people and businesses are incentivized to take out additional loans to invest in hard assets. This increased bank lending fuels further money creation, keeping inflation elevated. Under fiscal dominance, inflation tends to remain stubbornly high regardless of where interest rates are set.

We’ve seen this dynamic before. During the 1940s, particularly throughout World War II, the U.S. government ran massive fiscal deficits to fund the war and postwar reconstruction. As a result, inflation outpaced interest rates, causing bondholders to experience real losses – about 38% over the decade - after adjusting for inflation. The coming decade may very well echo the economic patterns of the 1940s.

If so, traditionally “safe” assets like long-duration U.S. treasuries may soon become liabilities that lose purchasing power. Investors may be better suited to focus on real, durable stores of value, such as gold, Bitcoin, real estate, and natural resources.

Fiscal dominance signals a break from the monetary era investors have known for decades. In this new regime, deficits drive inflation, shape asset prices, and set the terms of economic reality. Navigating this shift requires a move away from nominal promises like bonds and toward real, resilient assets. Those who adapt stand to preserve, or even grow, their purchasing power. Those who don’t risk being caught flat-footed in a system that no longer plays by the old rules.

This publication is for informational and educational purposes only — not investment, legal, tax, or accounting advice. Nothing herein constitutes a solicitation, recommendation, or offer to buy or sell any security or strategy. The author may hold — and may buy or sell without notice — securities, derivatives, or other instruments referenced. All opinions are the author’s, expressed in good faith as of publication, and subject to change without notice. Information is believed accurate but provided “as is,” without representations or warranties; errors or omissions may occur. Any forward-looking statements involve risks and uncertainties that may cause actual results to differ materially. Past performance is not indicative of future results. Do your own research and consult a qualified, licensed adviser who understands your circumstances before acting on this content. To the fullest extent permitted by law, the author and publication disclaim liability for any loss arising from reliance on this material.

The Titanic plates are shifting... The US is losing the global dominance created by the self-inflecting policies. Spending must be trimmed and the Govt. natural assets must be repriced to back the deficit (AKA - change how GDP is calculated)

Excellent read, I forwarded it to three friends who are open minded,

Hope to see you today at the SF meetup, the LV convention next week or a future meetup.